Surcharge are becoming more well known for spouses and when the numbers are crunched, risk assessments are performed along with any other type of risk numbers such as mortality rates, etc. and the results must be saying “dump the spouse” according to this article in Market Watch. This is pretty much talking about employer provided insurance. There are people out there that marry for this, well almost but it certainly is a big consideration, and maybe they really do. A couple years ago we had this story on the web.

are performed along with any other type of risk numbers such as mortality rates, etc. and the results must be saying “dump the spouse” according to this article in Market Watch. This is pretty much talking about employer provided insurance. There are people out there that marry for this, well almost but it certainly is a big consideration, and maybe they really do. A couple years ago we had this story on the web.

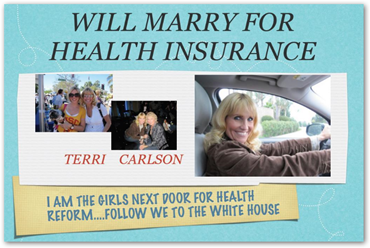

Will Marry For Health Insurance Web Site – Nobody Cares, Responds, The Reality of A 30 Second Attention Span

Some companies have policies that discourage spouses and some just make it too expensive to add them. The problem too is that some individuals can’t get insurance otherwise. The surcharges can be as much  as $100 a month and depending on income that can be a big issue or an inconvenience. In 2014 we shall how this works as there will be exchanges for spouses to get insurance outside the company with the next provisions of the healthcare reform kick in. Some companies will only allow the spouse added on if they already have their own insurance. If plans are different and cover different doctors then both can’t see the same doctor. Risk assessments and costs are working on all budgets today. In some cases with Medicaid as this link below states, people get divorced to get coverage and it all comes back to income and how the numbers work out. This sure doesn’t do much for keep the American tradition of family together. BD

as $100 a month and depending on income that can be a big issue or an inconvenience. In 2014 we shall how this works as there will be exchanges for spouses to get insurance outside the company with the next provisions of the healthcare reform kick in. Some companies will only allow the spouse added on if they already have their own insurance. If plans are different and cover different doctors then both can’t see the same doctor. Risk assessments and costs are working on all budgets today. In some cases with Medicaid as this link below states, people get divorced to get coverage and it all comes back to income and how the numbers work out. This sure doesn’t do much for keep the American tradition of family together. BD

Divorce for Medicaid and Marry for Insurance – The American Healthcare System

By denying coverage to spouses, employers not only save the annual premiums, but also the new fees that went into effect as part of the Affordable Care Act. This year, companies have to pay $1 or $2 “per life” covered on their plans, a sum that jumps to $65 in 2014. And health law guidelines proposed recently mandate coverage of employees’ dependent children (up to age 26), but husbands and wives are optional. “The question about whether it’s obligatory to cover the family of the employee is being thought through more than ever before,” says Helen Darling, president of the National Business Group on Health

Such exclusions barely existed three years ago, but experts expect an increasing number of employers to adopt them: “That’s the next step,” Darling says. HMS, a company that audits plans for employers, estimates that nearly a third of companies might have such policies now. Holdouts say they feel under pressure to follow suit. “We’re the last domino,” says Duke Bennett, mayor of Terre Haute, Ind., which is instituting a spousal carve-out for the city’s health plan, effective July 2013, after nearly all major employers in the area dropped spouses.

About a fifth of companies had policies to discourage spouses from joining their health plan in 2012, according to Mercer, though most just charged extra—$100 a month, on average—to cover spouses who could get insurance elsewhere, rather than deny coverage entirely. Indeed, large firms including generics maker Teva and supply chain manager Intermec have spousal surcharges costing $100 a month, or $1,200 annually, while Xerox charges $1,000 for the year

Some companies drive spouses away using other tactics, such as making spousal coverage prohibitively expensive through higher surcharges or by making reimbursement rates so low that spouses can’t afford the plans.

http://www.marketwatch.com/story/why-your-boss-is-dumping-your-wife-2013-02-22?link=sfmw

0 comments :

Post a Comment